HOW TO USE ANALYTICS TO RESOLVE DISAGREEMENTS AND AID NEGOTIATIONS

Did you know that analytics can be used to resolve disputes and aid negotiations?

Take the example of two hypothetical companies negotiating the terms of a contract. ConGlom, the principal, wishes to engage the services of ManageCo. The two companies are negotiating the terms of the contract and need to reach agreement on the following issues:

• contract end date

• billing arrangements

• renewal provisions

• quality assurance (QA) and compliance arrangements

• intellectual property (IP), and

• pricing.

Analytic techniques can be used to determine which company’s position on each of these six issues yields the best overall result. Here’s how.

An Integrated Bargaining Position

This process outlined here is derived from the ‘adjusted winner’ procedure detailed in Steven Brams’ and Alan Taylor’s book The Win-Win Solution. Each company has its respective position on each of the six matters, and each goes through a process (separately) where they distribute 100 notional points to each issue according to that issue’s importance: if a company cares significantly about an issue they will distribute more points to it, say 35 or 40. The items they care less about will only receive a small number of points (say, five, or even zero).

Each company only has 100 points to distribute; acts in good faith to maximise its own position, and doesn’t attempt to second-guess the position of the other company. Once deciding their distribution, neither company can change it to ‘game’ the system.

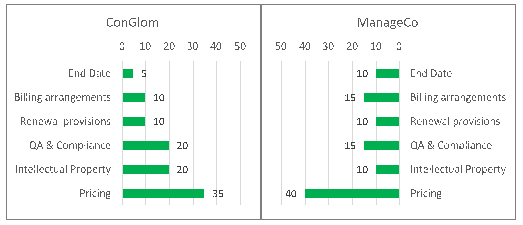

After deliberating, each company’s final distribution of points to issues is as follows:

Here’s the first point to note: how many negotiations are you aware of (or been part of) that bring to the table such a degree of thought and intentionality? How many where each factor is weighed and prioritised into an integrated bargaining position? And yet this is before even a single number has been crunched…

Each company’s distribution totals to 100 (you can check for yourself). Clearly each is most concerned about pricing, but after that things are mixed: ConGlom is most concerned about QA & compliance, and IP, whereas for ManageCo all other concerns are relatively evenly spread with only a five-point difference.

We can take this information and use it to aid the negotiations, and possibly even to provide an optimal solution agreeable to all parties.

Analytics, Applied … to Negotiations

A technique known as linear programming is utilised to find the allocation of each issue (end date, billing arrangements, IP, etc.) to a company; in other words, to determine which company’s position is adopted for which particular issue. The aim is to maximise the total number of points for both companies, and ensure each company gets the same number of points. Under this outcome the overall level of satisfaction is maxed-out, and there is equity for each party: in effect, each party is equally satisfied.

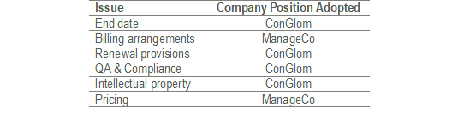

Typically, only one company can get its way for each of the six issues; accordingly, after we apply the linear programming the following is the best allocation of issues to companies:

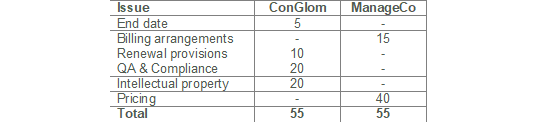

This allocation gives a total of 110 points, with both companies receiving 55 points each: a quick check of the allocation from the above table and the points from the earlier graph confirms this:

While there are many combinations that allocate a particular issue to a particular company, this combination gives the highest overall count of points while ensuring each company receives the same number of points.

Under this allocation, ManageCo has the say on the all-important pricing issue, and only gets its way on one other issue (billing arrangements) while ConGlom’s position is adopted on each of the end date, renewal, QA, and IP issues.

Not a bad outcome, and one that feels quite fair (as well as having equity in purely mathematical terms).

Another Scenario: Splitting the Difference on Price

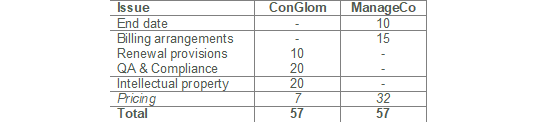

As conclusive as this seems, this is not the end of the story. The flexibility of analytic techniques offers other approaches to structure the negotiations. Let’s consider the case where, as before, only one of the companies gets its way for each of the first five issues (end date, billing, renewal, QA and IP) but where a fractional split is allowed between each company’s preferred position for the sixth issue (contract price). How does this change the results?

Here are the results after re-running the program:

Interestingly, under this outcome billing, renewal, QA and IP remain as per the previous allocation of issues to companies. Only the contract end date provisions switch from ConGlom to ManageCo. The split of pricing would be handled by taking the difference in the company’s respective contract prices and weighting the differential in contract price according to the proportions of the points.*

It’s highly instructive to see that the aggregate score only increases to 114 points (from the previous case where it was 110) when the requirement for allocation of pricing to only one party is relaxed and a fractional split is allowed. Each company only receives 57 points where a fractional split of pricing is allowed, compared to 55 where pricing is allocated in full to one or other company.

Fascinating ... and very useful during contract negotiations.

* * *

It’s conceivable that the parties could have reached an outcome similar to one of the above, but it’s highly doubtful they could have done so as quickly as this process would take, or without the obligatory posturing and ambit claims. The longest part of the process would be each party determining its distribution of points to each issue.

Implementation Considerations

There are a few observations to make about the implementation of this methodology:

Realistically, this technique would not substitute for formal negotiations between parties; it would most likely be used as an input to help structure negotiations, and to expedite them.

Using a third-party such as a consultant to oversee the collection of each party’s distribution of points and run the analysis would bring an extra layer of objectivity to the process.

There are a number of different ways the process could be run in terms of whether (and when) each company revealed its allocation of points to the other party.

This technique could also be used as a strategic competitive measure by one of the parties to the negotiations. This company could simulate various bargaining scenarios using its best estimates of the other party’s distribution of points, ahead of the actual negotiations…

* * *

I will provide more case studies of analytics techniques being applied to real-world management situations in future e-newsletters.

In the meantime, if you have any queries about how analytics can be applied in your organisation, please call me on 0414 383 374 or email info@mcarmanconsulting.com.

Warm regards,

Michael

Director I Michael Carman Consulting

PO Box 686, Petersham NSW 2049 I M: 0414 383 374

* Along the lines of the following: there are 39 points in total for the pricing issue [7 + 32]. Assuming ConGlom wanted a lower contract price than ManageCo, the contract price difference could be settled as 82 percent (ie. 32 divided by 39) of the difference being added to ConGlom’s preferred price or (what amounts to the same thing) 18 percent (7 divided by 39) of the difference being taken off ManageCo’s preferred price.

References:

Steven J. Brams & Alan D. Taylor (2000) The Win-Win Solution W.W. Norton & Co.

Wayne L. Winston & S. Christian Albright (2016) Practical Management Science Cengage Learning.

© Michael Carman 2017